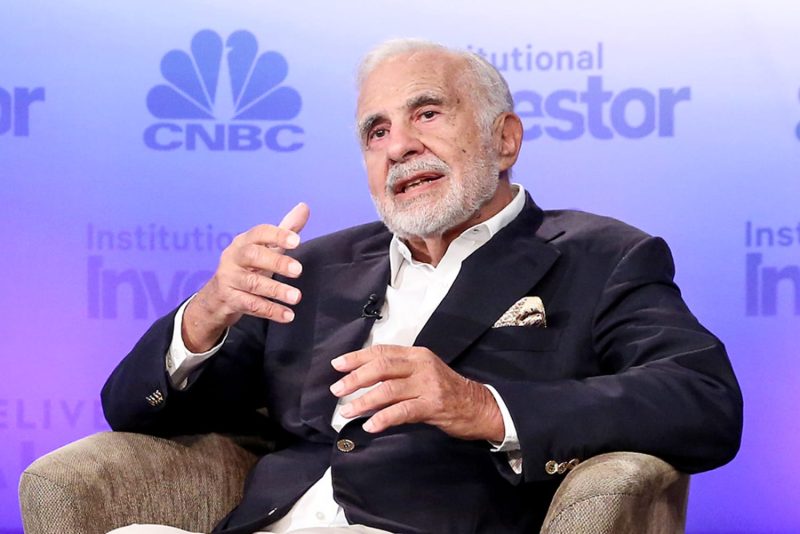

Secrets Unveiled: SEC Accuses Carl Icahn of Concealing Billions in Stock Pledges

In a shocking turn of events, the Securities and Exchange Commission (SEC) has charged renowned billionaire investor Carl Icahn with allegedly concealing billions of dollars’ worth of stock pledges. The SEC has accused Icahn of violating federal securities laws by failing to disclose these stock pledges in a timely and accurate manner.

This legal action against Carl Icahn sheds light on the intricate world of stock pledges and the regulatory importance of transparency in financial dealings. Stock pledging is a common practice among investors and high net-worth individuals seeking to access cash without selling off their shares. By using their stock holdings as collateral, these individuals can secure loans or other forms of liquidity without losing ownership of their investments.

However, while stock pledges themselves are not inherently illegal or unethical, the SEC requires investors to disclose such arrangements in a timely and transparent manner. This is to ensure that investors, regulators, and the public have a clear understanding of an individual’s financial commitments and potential conflicts of interest.

In the case of Carl Icahn, the SEC alleges that he failed to disclose certain stock pledges to a group of companies he controlled, as required by law. By withholding this crucial information, Icahn may have obscured the true extent of his financial entanglements and potential risks to investors relying on his public statements and actions.

The SEC’s decision to charge Carl Icahn underscores the regulatory agency’s commitment to upholding fair and transparent financial markets. By holding individuals accountable for their disclosure obligations, the SEC aims to protect investors from misleading or incomplete information that could impact their investment decisions.

Furthermore, this case serves as a reminder to all investors, particularly high-profile figures like Carl Icahn, of the importance of compliance with securities laws and regulations. Transparency and accountability are cornerstones of a well-functioning financial system, and individuals who fail to uphold these principles risk facing legal consequences and reputational damage.

As the legal proceedings against Carl Icahn unfold, the financial community will be closely monitoring the outcome and its potential implications for investor disclosure practices. In the meantime, this case highlights the continued importance of regulatory oversight in maintaining the integrity and trustworthiness of our capital markets.