Investing in Chromium Stocks: A Comprehensive Guide for 2024

Understanding Chromium

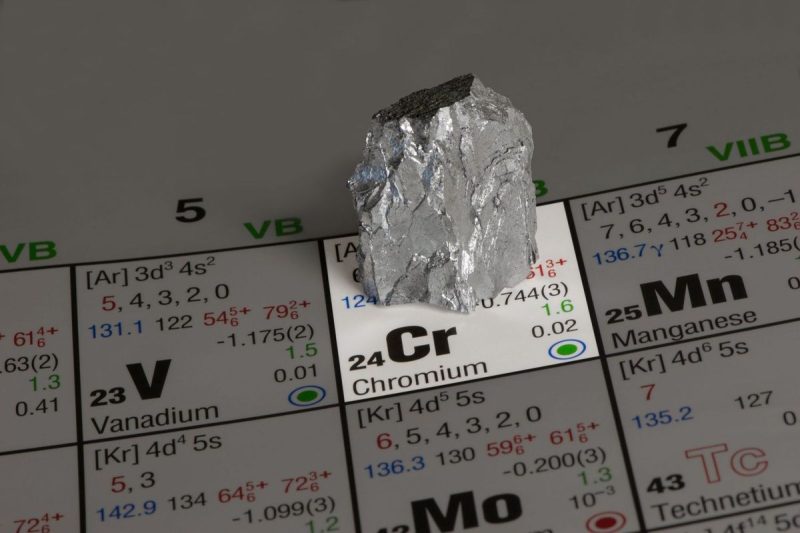

Before delving into how to invest in Chromium stocks, it is essential to have a basic understanding of what Chromium is and its significance in various industries. Chromium is a hard, corrosion-resistant transition metal that is commonly used in manufacturing stainless steel, as well as in various industrial applications such as aerospace, automotive, and chemical industries. With its unique properties, Chromium plays a crucial role in the global economy and is in high demand across multiple sectors.

Factors Affecting Chromium Prices

The price of Chromium is influenced by a variety of factors that can impact its supply and demand dynamics. One key factor is the global economic environment, as the demand for Chromium is closely tied to economic growth, particularly in emerging markets where infrastructure development drives the need for stainless steel and other Chromium-based products. Additionally, geopolitical events, trade policies, and mining regulations can also affect the availability and cost of Chromium, making it essential for investors to stay informed about these factors.

Options for Investing in Chromium Stocks

There are several ways in which investors can gain exposure to Chromium stocks, ranging from individual companies to Exchange-Traded Funds (ETFs) that track the performance of Chromium producers. Investing in individual Chromium mining companies can provide investors with direct exposure to the price movements of the metal, as well as the potential for company-specific growth and dividends. However, this approach also carries higher risks due to factors such as operational challenges and market volatility.

For investors seeking a more diversified exposure to Chromium stocks, investing in ETFs that focus on the materials sector can be a viable option. These ETFs typically hold a basket of stocks from companies involved in mining, processing, and supplying Chromium, offering investors a way to spread their risk across multiple companies within the industry. Additionally, ETFs often provide lower management fees and greater liquidity compared to investing in individual stocks.

Key Metrics to Consider When Investing in Chromium Stocks

When evaluating Chromium stocks for investment, there are several key metrics and factors that investors should consider to make informed decisions. These include:

1. Company Fundamentals: Assessing the financial health, profitability, and growth prospects of Chromium mining companies is crucial for determining their long-term investment potential.

2. Global Demand Trends: Understanding the demand outlook for Chromium across different industries and regions can help investors anticipate future price movements and opportunities in the market.

3. Regulatory Environment: Keeping track of mining regulations, environmental policies, and trade barriers that may impact Chromium production and pricing is essential for mitigating risks.

4. Technical Analysis: Utilizing technical indicators and price charts can help investors identify trends, entry points, and exit strategies for trading Chromium stocks.

Conclusion

In conclusion, investing in Chromium stocks can be a rewarding opportunity for investors looking to capitalize on the growing demand for this essential metal in various industries. By understanding the factors influencing Chromium prices, exploring different investment options, and conducting thorough research on companies and market trends, investors can make informed decisions to build a successful portfolio in the Chromium sector.