Investing in tin stocks can be a lucrative venture for those seeking exposure to the industrial metal market. Tin is a versatile metal with several industrial applications, making it a valuable commodity for investors looking to diversify their portfolios. In this guide, we will discuss the key steps and considerations to keep in mind when investing in tin stocks.

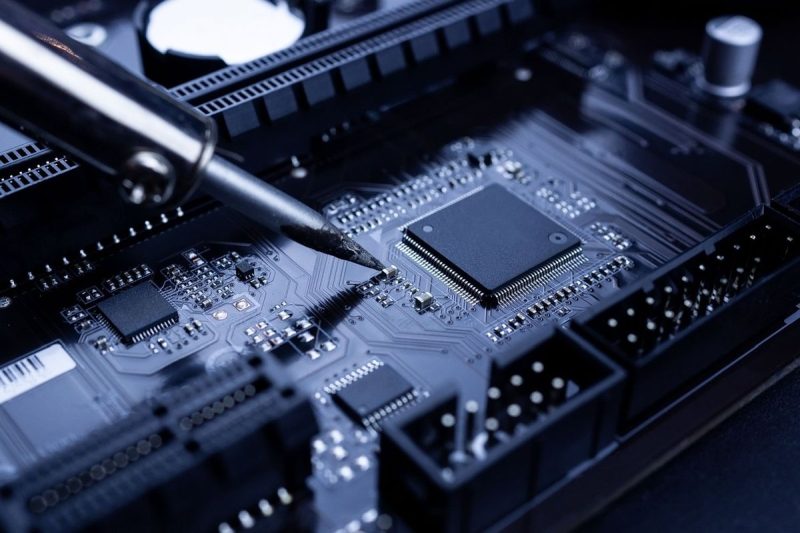

1. Understand the Tin Market: Before investing in tin stocks, it is essential to familiarize yourself with the dynamics of the tin market. Tin is widely used in industries such as electronics, construction, and automotive, which drives its demand. Stay informed about global trends, supply and demand balance, and market factors that could impact tin prices.

2. Research Tin Mining Companies: When investing in tin stocks, research and identify reputable tin mining companies with strong fundamentals and growth potential. Consider factors such as production capacity, reserves, cost management, and exploration activities. Look for companies with a solid track record of operational efficiency and financial stability.

3. Evaluate Tin Stock Performance: Analyze the historical performance of tin stocks to identify trends and patterns. Look at key performance indicators such as stock price movements, earnings growth, dividend payouts, and market capitalization. Pay attention to how tin prices and global economic conditions have influenced the performance of tin stocks in the past.

4. Diversify Your Portfolio: As with any investment, diversification is key to managing risk effectively. Consider investing in a mix of tin stocks, other industrial metal stocks, and broader market indexes to balance the risks and potential returns. Diversifying your portfolio can help mitigate the impact of volatility in the tin market.

5. Stay Informed: Keep yourself updated with the latest news and developments in the tin industry. Stay informed about regulatory changes, geopolitical events, and technological advancements that could impact the tin market. Follow industry reports, research publications, and company announcements to make informed investment decisions.

6. Monitor Market Trends: Monitor tin prices, supply and demand dynamics, and macroeconomic indicators to gauge the health of the tin market. Stay alert to geopolitical risks, trade tensions, and other factors that could influence tin prices and stock performance. Regularly review your investment thesis and adjust your portfolio strategy as needed.

7. Seek Professional Advice: If you are new to investing or unsure about how to proceed with tin stocks, consider seeking advice from financial advisors or investment professionals. They can provide personalized guidance and help you navigate the complexities of the tin market to make informed investment decisions.

Investing in tin stocks can offer attractive opportunities for investors looking to gain exposure to the industrial metal sector. By understanding the tin market, researching tin mining companies, diversifying your portfolio, staying informed, monitoring market trends, and seeking professional advice, you can navigate the complexities of investing in tin stocks successfully. As with any investment, it is essential to conduct thorough research and exercise caution to make sound investment decisions in the dynamic tin market.